NEW CALIFORNIA LAWS FOR 2023 STRESS SAFETY, MORE REGULATIONS, AND ADDRESS WORKPLACE DISPARITY

Barry A. Bradley, Esq., Managing Partner, Bradley, Gmelich + Wellerstein, CALSAGA Legal Advisor

California’s Governor Newsom signed 997 bills last year (and vetoed 169). While there was a flurry of laws that protect women’s reproductive rights as a result of the overturning of Roe v. Wade by the U.S. Supreme Court, January 1st marks the enforcement of many other laws about which you should be aware.

Some will impact how you maneuver on the streets and sidewalks, some will impact employers as well as their employees and even job applicants, while another will protect the hides of some of our non-human animals. Many that are noteworthy, or just plain interesting, are summed-up below.

2023 Is The Year Of The Jaywalker

It’s true! You no longer have to cross streets only within crosswalks, only on green signals, only when the “Walk” sign is green, and only at corners. Thanks to Assembly Bill (AB) 2147, peace officers can no longer stop a pedestrian for jaywalking violations UNLESS “a reasonably careful person would realize there is an immediate danger of a collision with a moving vehicle or other device moving exclusively by human power.”

While cars must always yield to pedestrians, you should always look out for your own safety and use reasonable care when crossing.

Bikers Rule!

In an effort to encourage more cycling and also to protect cyclists on the road, the legislature passed the OmniBike Bill, AB 1909 that will make life a little safer and protected for our two-wheeler friends and family members.

Autos Must Change Lanes to Pass a Bike. It is no longer okay to pass bicyclists with just 3-feet of space between the biker and your car. Where possible, motorists must treat bikers as if they are any other car, including signaling, going around them into another lane to pass, and provide adequate room. This will hopefully reduce the hundreds of “near misses” that occur every day, not to mention serious accidents.

E-Bikes Allowed on All Bikeways

Move over, Tesla! The electric bike is here to stay. This bill outlaws municipalities from limiting access on bike lanes and bike paths. This will allow e-bike riders to make use of the designated bike lanes and trails as an added measure of safety. (For those concerned about our environmental impact, the e-bikes are still not allowed on equestrian and hiking trails.)

Bikes Can Cross on WALK signals

Pedestrians, look out! Bikes can make use of the crosswalks and enjoy the safety that pedestrians have.

No More Bicycle Licensing Ordinances

And lastly, cities can no longer charge a fee or require registration of bicycles. (However, bicyclists can still voluntarily register their bikes so they can be located in the case of theft.)

Pay Data Reporting and Pay Scale Disclosures

As of January 1st, companies with 15 or more employees in California are now required to list salary ranges for all job postings. Senate Bill (SB) 1162 requires an employer to provide pay scale to an applicant or to an employee upon request.

This new law complements previous legislation, SB 973, signed into law in 2020, which requires employers with more than 100 employees to submit wage data to the state’s Department of Fair Employment and Housing.

Failure to disclose the pay scale can result in stiff penalties for violators, and could also lead to a complaint with the Labor Commissioner or a civil action for an injunction against the company.

FAMILY LEAVE FOR MOURNING AND FOR CARING FOR NON-FAMILY MEMBERS

The California Family Rights Act (“CFRA”) has been amended to include bereavement leave. Under AB 1949 all employers with 5 or more employees must now provide any employee who has worked for them for at least 30 days the right to take 5-days of unpaid bereavement leave for the death of a family member.

Who Says You Can’t Pick Your Family?

Your close friend who’s “just like a brother to you” may now qualify as a “Designated Person” for whom you can take an unpaid leave of absence to care for. Under AB 1041, the CFRA is expanded to allow employees to add to the list one extended family member or a person they consider to be family for whom the employee needs to provide care.

With the close cross-over between CFRA and the Family Medical Leave Act (“FMLA”), a qualified employee under FMLA may now possibly be able to take up to 24-weeks of unpaid leave over a 12-month period, and still have their job protected! (Work is overrated anyway!)

PRACTICE POINTER: Update your employee handbooks and policies to reflect the new law.

STATE HOLIDAYS: JUNETEENTH And the LUNAR NEW YEAR

California now recognizes two new holidays as State Holidays.

Juneteenth commemorates the end of slavery in the United States. Juneteenth (short for “June Nineteenth”) marks the arrival of federal troops in Galveston, Texas in 1865 to ensure that all enslaved people be freed. This holiday is now codified in AB 1655.

This year also marks the Lunar New Year as an official state holiday. AB 2596 describes the calculation date. This is a moving target each year as it falls on “the second new moon following the winter solstice, or the third new moon following the winter solstice should an intercalary month intervene.” (Got that?)

While Juneteenth is a judicial holiday, the Lunar New Year is not yet federally recognized and will result in our state and federal courts remaining open. Other non-judicial State Holidays include Genocide Remembrance Day and Native American Day.

PRACTICE POINTER: Update your Employee Handbooks to include these new holidays!

New Laws Impacting “Proprietary” (In-House) Security Forces

While most of us know that licensed private security guard companies provide guards to patrol businesses, buildings and residences, there is another side to security that has been largely unregulated.

“Proprietary Security” is that which is provided by a business or school where the uniformed guards are directly employed by the business or school and not by a licensed security company. (Think shopping malls, theme parks, certain department stores, many jewelry stores, bar bouncers, and most community college campus security forces. These are “Proprietary Security.”)

AB 2515 has made some massive changes to the security industry, many of which directly impact this previous minimally regulated side of the security.

Registration Required

Proprietary Security Officers must be registered with the California Bureau of Security & Investigative Services (BSIS), and produce their registration upon demand to any law enforcement officer. All officers must undergo a criminal background check and receive some training on the laws of the state.

Self-Reporting All Uses of Force

Riding the wave of reigning-in the use of force by police agencies, existing law was imposed on the licensed private security companies to ensure each guard received training, background checks and had to report all uses of force during an altercation. (See, AB 229.)

Under the new law, AB 2515, Proprietary Security Guards and their employers must report any physical altercation with a member of the public while on duty to (BSIS) within 7-business days. This now imposes the same reporting requirements that the licensed security companies have complied with for years. The goal is to enhance the safety of the public.

The bill also requires actual training in the de-escalation of a situation and use of force training. (Although not nearly as robust as the training required of the licensed private security guard companies and their security officers, it is a good start.)

No More Weapons of Any Kind

Under AB 2515, Proprietary (In-House) Security officers are no longer allowed to carry any type of weapons. This includes batons, pepper spray, Tasers, & of course, firearms.

The law took effect on January 1st, and violators could face stiff fines and even misdemeanor charges. (The use of force training won’t go into effect until July 1st.)

Another Year, Another Rose to Minimum Wage

Beginning January 1, 2023, the statewide minimum was supposed to increase to only $15.00 for employees with less than 26 employees and to $15.50 for employees with 26 or more employees.

However, due to inflation, the statewide minimum wage has increased to $15.50 for ALL employees. (Remember that some local jurisdictions impose a higher minimum wage.) This also means that exempt employees in California must be paid a minimum annual salary of $64,480.

Furless California

Finally, Animals throughout the state are ringing in the New Year with glee. Following California’s concern and compassion for our four-legged friends, California is the first state to ban and outlaw the sale and production of animal fur products. The landmark law, AB 44, went into effect on January 1st, 2023, making it illegal to sell new items made from the fur of undomesticated animals, including mink, rabbit and coyote. The law passed in 2019 and went into effect on January 1st, 2023.

The law, sponsored by the Humane Society of the United States, reflects the evolving attitudes of compassionate Californians who reject fashion made from animals, and paves the way for other states to follow suit. It carries hefty fines for violators. (The bill excludes the use of fur for religious and cultural purposes.)

Barry A. Bradley is the managing partner of Bradley, Gmelich & Wellerstein LLP where he oversees the firm’s Business and Employment Department and heads up the firm’s Private Security Litigation Team. A former Deputy District Attorney, Barry’s practice concentrates on licensing, employment and business related issues, defending cases involving negligent security, as well as assisting clients in avoiding liability through proactive, preventative measures.

Barry A. Bradley is the managing partner of Bradley, Gmelich & Wellerstein LLP where he oversees the firm’s Business and Employment Department and heads up the firm’s Private Security Litigation Team. A former Deputy District Attorney, Barry’s practice concentrates on licensing, employment and business related issues, defending cases involving negligent security, as well as assisting clients in avoiding liability through proactive, preventative measures.

The firm acts as general counsel for many security companies in California. Barry is a Legal Advisor to The California Association of Licensed Security Agencies, Guards & Associates (CALSAGA) and other non-profits.

He has been conferred an AV-Preeminent Peer Rating by Martindale Hubbell, the highest rating attainable, and has been named a Southern California Super Lawyer for the past 16 consecutive years in the area of Business Litigation. Barry is also the recipient of CALSAGA’s Security Professional Lifetime Achievement Award. bbradley@bgwlawyers.com 818-243-5200.

About Bradley, Gmelich & Wellerstein LLP

Founded in 2000, Bradley, Gmelich & Wellerstein, LLP is dedicated to providing sound advice and exceptional results for our clients. Our twenty-five plus skilled, dedicated and diverse attorneys represent individuals and businesses of all sizes in a wide variety of business, employment law and litigation matters. www.bgwlawyers.com.

Saba Zafar is Special Counsel in Bradley, Gmelich & Wellerstein LLP’s Employment Law Department. Ms. Zafar has over a decade of experience as an attorney, primarily in employment law. Ms. Zafar focuses her practice of providing strategic advice and counsel in all aspects of employment law and workplace matters, including drafting and implementation of HR policies and procedures, Employment Handbooks, providing advice to clients on personnel issues as well as general business matters.

Saba Zafar is Special Counsel in Bradley, Gmelich & Wellerstein LLP’s Employment Law Department. Ms. Zafar has over a decade of experience as an attorney, primarily in employment law. Ms. Zafar focuses her practice of providing strategic advice and counsel in all aspects of employment law and workplace matters, including drafting and implementation of HR policies and procedures, Employment Handbooks, providing advice to clients on personnel issues as well as general business matters.

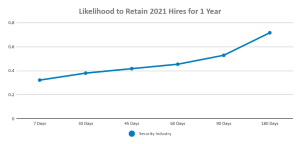

Andrea has over 15 years of software-as-a-service (SaaS) marketing experience. In her role as Marketing Director at TEAM Software by WorkWave, she drives the company’s strategic marketing direction globally. She is a graduate of the University of Nebraska-Lincoln, where she earned her Bachelor’s degree in Journalism.

Andrea has over 15 years of software-as-a-service (SaaS) marketing experience. In her role as Marketing Director at TEAM Software by WorkWave, she drives the company’s strategic marketing direction globally. She is a graduate of the University of Nebraska-Lincoln, where she earned her Bachelor’s degree in Journalism. Brandy Tomasek joined TEAM Software by WorkWave in 2016. She’s a part of the Client Experience team, working as a Sr. Implementation Lead and Business Consultant. Prior to joining TEAM Software, Brandy earned a Bachelor’s degree in Management and Marketing, as well as her MBA in Organizational Leadership. Brandy’s professional experience spans a range of disciplines from back office accounting to management and leadership in various industries.

Brandy Tomasek joined TEAM Software by WorkWave in 2016. She’s a part of the Client Experience team, working as a Sr. Implementation Lead and Business Consultant. Prior to joining TEAM Software, Brandy earned a Bachelor’s degree in Management and Marketing, as well as her MBA in Organizational Leadership. Brandy’s professional experience spans a range of disciplines from back office accounting to management and leadership in various industries.