WHAT’S THE DIFFERENCE BETWEEN AN ATS AND A JOB BOARD?

Jeff Davis, Kwantek, CALSAGA Network Partner

As we enter a new decade, it’s fun to reflect on how hiring has changed over the past 10 years.

As we enter a new decade, it’s fun to reflect on how hiring has changed over the past 10 years.

The job board landscape continues to ebb and flow. Dominant players from the early 2000’s, like Craigslist and Monster, have faded to the background, while new business models and social platforms continue to drive more applicants (is the term ‘freemium’ antiquated yet?).

Nothing has spurred change more than record low unemployment rates.

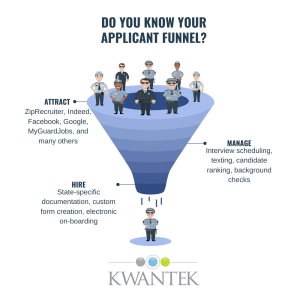

High-turnover industries have adopted digital marketing strategies to lure candidates and manage a pipeline. In these industries, the hiring process resembles a funnel. As competition for workers increases, high-turnover companies are rightly tempted to do everything they can to fill the top of that funnel with more applicants.

With dwindling margins and limited recruiting budgets, it’s tempting to look at spending all your budget on one job board simply for volume.

But the top of the funnel is only one stage to improve, and there are many ways to accomplish that goal. While job boards have added functionality over the past few years, they still don’t have the firepower needed for all recruiting organizations.

Before you make such a move, ask yourself these key questions:

Can the job board manage my hiring process? Job boards are designed to find applicants. Applicant Tracking Systems (ATS) are designed to move those applicants through your hiring process. A ‘one size fits all’ workflow may not be best for your organization if you have high hiring volume.

How will the applicant data flow into our other systems? Will the applicant information flow into your background check vendor and onboarding paperwork? What about your ERP or payroll?

Redundant data entry is frustrating and expensive, and let’s face it – no one wants to run afoul of state and federal requirements. EEO, I-9’s, the new W4, and constantly changing state requirements should all factor into your hiring workflow. If you’re only using a job board, be sure to have a separate system in place to gather critical employee paperwork to maintain compliance.

Am I getting all the information I need to make the right hire? The ‘easy apply’ trend has been fantastic for job seekers who can apply to multiple jobs in short order, but often employers need more info. Can the job board collect your entire application?

Will a single job board give me the quality applicants I need? Our data shows that different job boards attract different pools of candidates. Have you reviewed your hiring data to see which job board gives you the best quality candidates?

Like real estate markets, hiring is local and varies market to market.

We find that certain job boards work well in rural markets but fail in big cities. Some industries see fantastic results with ‘guerilla’ style recruiting tactics like fliers.

There is no perfect job board for all industries and markets, just like there is no singular hiring process for all organizations. Make sure you’re partnering with solution providers who diversify your applicant pool while helping you create efficiencies for your organization.

If you’d like to learn more about how to improve your hiring process, we’d love to talk! Click here to talk to us about your situation and see how Kwantek can help, or click here for additional helpful resources.

Jaimee K. Wellerstein is a Partner at Bradley & Gmelich LLP, and the Head of the firm’s Employment Department. Jaimee concentrates her practice in representing employers in all aspects of employment law, including defense of wage and hour class actions, PAGA claims, discrimination, retaliation, harassment, wrongful discharge, misclassification, and other employment related lawsuits. She also provides employment counseling and training in all of these areas.

Jaimee K. Wellerstein is a Partner at Bradley & Gmelich LLP, and the Head of the firm’s Employment Department. Jaimee concentrates her practice in representing employers in all aspects of employment law, including defense of wage and hour class actions, PAGA claims, discrimination, retaliation, harassment, wrongful discharge, misclassification, and other employment related lawsuits. She also provides employment counseling and training in all of these areas. Annette M. Barber is Special Counsel on Bradley & Gmelich LLP’s Employment Team. She represents clients providing employment advice and counsel in all aspects of hiring, performance management, training, compensation, and termination. Annette spent the past 17 years working with a global security company of 100,000 U.S. employees as an employment law attorney and then as Corporate Vice President directing HR Compliance nationwide for all 50 states, Puerto Rico and Guam.

Annette M. Barber is Special Counsel on Bradley & Gmelich LLP’s Employment Team. She represents clients providing employment advice and counsel in all aspects of hiring, performance management, training, compensation, and termination. Annette spent the past 17 years working with a global security company of 100,000 U.S. employees as an employment law attorney and then as Corporate Vice President directing HR Compliance nationwide for all 50 states, Puerto Rico and Guam. Tory Brownyard, CPCU, is president of Brownyard Group (

Tory Brownyard, CPCU, is president of Brownyard Group (

Shaun Kelly joined Tolman & Wiker Insurance Services in 2005. He specializes in all lines of property and casualty insurance for industries including contract security firms, agriculture, construction, oil and gas. Shaun received a BS in Business Administration with a major in Finance from California State University in Fresno, California. He is an active member of several industry associations, including the Association CALSAGA, the Kern County Builders Exchange and the Independent Insurance Agents of Kern County. Shaun can be reached at 661-616-4700 or skelly@tolmanandwiker.com.

Shaun Kelly joined Tolman & Wiker Insurance Services in 2005. He specializes in all lines of property and casualty insurance for industries including contract security firms, agriculture, construction, oil and gas. Shaun received a BS in Business Administration with a major in Finance from California State University in Fresno, California. He is an active member of several industry associations, including the Association CALSAGA, the Kern County Builders Exchange and the Independent Insurance Agents of Kern County. Shaun can be reached at 661-616-4700 or skelly@tolmanandwiker.com. Tony Unfried holds a master’s degree in Public Affairs and Criminal Justice from Indiana University, where he graduated with honors. While enrolled in his master’s program, Tony worked for The TJX Companies, Inc., leading the region in loss prevention and moving the company toward technology use in Security. Tony went on to join the most significant security company in Indiana, managing more than 500 employees and 50 sites, including the Indiana Convention Center, Bankers Life Fieldhouse, and Ruoff Home Mortgage Music Center. Seeing a noticeable gap in technology use in the physical security sector, Tony created his first security software application, launched at the Super Bowl in 2012, and recognized twice for Excellence in Mobile Technology by Techpoint. Tony has also spoken on Tech in Physical Security on panels with ASIS and IAVM.

Tony Unfried holds a master’s degree in Public Affairs and Criminal Justice from Indiana University, where he graduated with honors. While enrolled in his master’s program, Tony worked for The TJX Companies, Inc., leading the region in loss prevention and moving the company toward technology use in Security. Tony went on to join the most significant security company in Indiana, managing more than 500 employees and 50 sites, including the Indiana Convention Center, Bankers Life Fieldhouse, and Ruoff Home Mortgage Music Center. Seeing a noticeable gap in technology use in the physical security sector, Tony created his first security software application, launched at the Super Bowl in 2012, and recognized twice for Excellence in Mobile Technology by Techpoint. Tony has also spoken on Tech in Physical Security on panels with ASIS and IAVM. Gregory B. Wilbur is a member of Bradley & Gmelich LLP’s Employment Department, where he provides aggressive and cost-effective representation to employer clients in a wide variety of proceedings in state and federal court and before administrative agencies. He has extensive experience litigating wage and hour class actions, PAGA representative actions, and discrimination, harassment, and retaliation lawsuits under various equal employment and whistleblower statutes. He has also represented clients in appeals of Cal/OSHA and Labor Commissioner penalty assessments, including seeking judicial review of administrative decisions.

Gregory B. Wilbur is a member of Bradley & Gmelich LLP’s Employment Department, where he provides aggressive and cost-effective representation to employer clients in a wide variety of proceedings in state and federal court and before administrative agencies. He has extensive experience litigating wage and hour class actions, PAGA representative actions, and discrimination, harassment, and retaliation lawsuits under various equal employment and whistleblower statutes. He has also represented clients in appeals of Cal/OSHA and Labor Commissioner penalty assessments, including seeking judicial review of administrative decisions. Named to IFSEC’s Global Influencers list 2018 for Security Thought Leadership, Mark is a business school graduate, CPP and Member of The Security Institute (MSyI). Mark’s background is in security services, corporate security, consulting and workforce software. A graduate of Concordia University in HR Management and International Business, he progressed to several senior management roles responsible for security business units across Canada, including serving as the Senior Manager for Corporate Security at Canada’s largest telecommunications company. He launched a consulting business focused on physical security for corporate clients, and has been teaching part-time at the Université de Montréal since 2016. Currently, Mark is the Vice-President, Security and Industry, in the software scaleup TrackTik, and volunteers as SRVP Region 6, Chair of the Security Services Council, the Private Security Officer Standard Technical Committee, and the Private Security Company (PSC.1) working group

Named to IFSEC’s Global Influencers list 2018 for Security Thought Leadership, Mark is a business school graduate, CPP and Member of The Security Institute (MSyI). Mark’s background is in security services, corporate security, consulting and workforce software. A graduate of Concordia University in HR Management and International Business, he progressed to several senior management roles responsible for security business units across Canada, including serving as the Senior Manager for Corporate Security at Canada’s largest telecommunications company. He launched a consulting business focused on physical security for corporate clients, and has been teaching part-time at the Université de Montréal since 2016. Currently, Mark is the Vice-President, Security and Industry, in the software scaleup TrackTik, and volunteers as SRVP Region 6, Chair of the Security Services Council, the Private Security Officer Standard Technical Committee, and the Private Security Company (PSC.1) working group Jon Druker has been in software product development for 20 years. He started in translation and moved into various roles in communications and product development. He’s worked for small, medium and large corporations developing and helping to market solutions to meet complex problems in different industries, such as telecommunications, mobile and retail. Recently he’s been involved in marketing efforts to explain and position software solutions in AI and now he’s working at TrackTik in the Go To Market team.

Jon Druker has been in software product development for 20 years. He started in translation and moved into various roles in communications and product development. He’s worked for small, medium and large corporations developing and helping to market solutions to meet complex problems in different industries, such as telecommunications, mobile and retail. Recently he’s been involved in marketing efforts to explain and position software solutions in AI and now he’s working at TrackTik in the Go To Market team.