The 2020 first quarter edition of The Californian: The Quarterly Newsletter of CALSAGA is now available!

THE IMPORTANCE OF INCREASING COMMUNITY SECURITY

Mark Folmer, TrackTik, CALSAGA Network Partner

In the aftermath of a string of attacks targeting various communities around the United States, many state officials are calling for more protection. In New York state, for example, the governor has announced increased patrols by the state police in communities to counter what he calls “domestic terrorism.” Several state lawmakers across the United States have also asked the National Guard to visibly patrol and protect communities.

In Long Beach, California police will increase visibility and perform additional patrols and have asked the public to alert police if they see anything suspicious. Los Angeles officials have also modified how they respond to world conflicts and terrorist acts as tactics change. Post-9/11, authorities focused on protecting large-scale targets like high-rises, famous landmarks, and airports. They are now looking more at “soft targets” after several attacks targeting crowds of people celebrating in their communities and pedestrians have occurred. Security is also being beefed up at the Los Angeles port and LAX.

Community Involvement

But it’s not just physical security that officials are changing. Some communities are creating neighbourhood safety coalitions, or neighborhood watch programs, which will allow communities to work together to catch signs of crime and violence and report them before anything happens.

“If you see something, say something™?” which became the unofficial slogan of post-9/11 America, is a national campaign that raises public awareness of the indicators of terrorism and terrorism-related crime, as well as the importance of reporting suspicious activity to state and local law enforcement. In the wake of the recent communal attacks, public awareness matters now more than ever.

A few ways you can help keep your community safe: pay attention to your surroundings, get to know the neighbors, use timers on lights inside your home, install motion-sensors on lights outside your home, and never post your vacation dates on social media. As you spend time in and around the community, if you see something that doesn’t seem quite right, say something. By being alert and reporting suspicious activity to your local law enforcement or security officials, you can protect your family, your neighbors, and your community.

Public safety and security is everyone’s responsibility though. If you see suspicious activity, report it to local law enforcement or a person of authority:

- Who did you see?

- What did you see?

- When did you see it?

- Where did it occur?

- Why is it suspicious?

The Role of Security Companies

Security companies can also play an integral role in keeping your community and property secure and safe. Many security companies, often working in collaboration with local police, offer home protection programs designed to deter and respond to criminal activity, safeguard homes and properties, and encourage residents to collectively protect their communities.

When hiring a security company, here are a few qualities that you should look for:

Reputable Industry Provider

It’s important to find a reputable and trustworthy service, regardless of the size of the company. Look for a security company that provides excellent customer service, has a solid reputation with positive reviews, and values client feedback. A quick Google search could reveal a company’s reputation through Linkedin and Facebook reviews.

Trained and Certified Guards

Ask your prospective security company about the qualifications of their staff. It’s important that the security company provides guards that are well-trained and vigilant. Extensive training and discipline can set a top security guard apart from the rest. Be sure to check for certificates and licenses to know how much training the security guard has. If the guards are authorized to carry firearms, additional qualifications and carry permits may be required. Trained security guards know how to respond to crime and how to address any criminal activity like theft or vandalism.

Innovative Technology

Is the company up-to-date with the latest innovations in security technology? Most security companies promise that their guards are always on-time, stay alert, and respond appropriately when an incident occurs. But that promise should be backed up by what should be standard in the security industry–a security solution that verifies check-in/check-out, documents patrols and duties, . You should make sure the company has the ability to track guard activity with GPS tracking which provides a dynamic, real-time map of the location of guards at all times.

Summary

With police departments under increasing pressure to protect communities, despite reduced budgets and staff, many security organizations believe that the future of community security lies in improved public-private partnerships. Right now, police departments around the country spend more time dealing with noise complaints and rescuing cats from trees than solving crimes and enforcing law. So it just makes good sense to use private security officers to support state, county, and municipal policies agencies where they can make an impact on the safety and security of our communities.

Securing our communities shouldn’t be the sole responsibility of any one organization though. It should be a partnership between the citizens of the community working together with police agencies and security companies. Protecting our communities is not just about preventing crime. It’s also for the well-being of all the families in the community thanks to private security’s contribution to safety.

Mark was named to the prestigious IFSEC Global influencers list in 2018 & 2019 for “Security Thought Leadership”. He is also a highly active international security figure, member of ASIS and a Fellow of the UK Security Institute, as well as a world renown data-driven Operations & Security leadership expert. Mark is based in Montreal, Canada with TrackTiK, a dynamic and cutting edge tech company. Mark is also a lecturer and commentator on global security issues.

Mark was named to the prestigious IFSEC Global influencers list in 2018 & 2019 for “Security Thought Leadership”. He is also a highly active international security figure, member of ASIS and a Fellow of the UK Security Institute, as well as a world renown data-driven Operations & Security leadership expert. Mark is based in Montreal, Canada with TrackTiK, a dynamic and cutting edge tech company. Mark is also a lecturer and commentator on global security issues.

THE BUDDING CANNABIS SECURITY INDUSTRY: A BEGINNER’S RESOURCE GUIDE

Chris Anderson, Silvertrac Software

Over the past decade, states all over the country have been slowly legalizing both medical and recreational cannabis use. However, industry regulations continue to be confusing, especially since each state manages its own cannabis regulations.

In order to better understand where the cannabis industry is going and what it means for your security operation, let’s start with some general knowledge of where exactly the country sits on the topic.

Cannabis regulation is almost exclusively managed at the state level. At the federal level, cannabis is categorized as a Schedule 1 substance, grouped with drugs like heroin and methamphetamine. This creates obvious hesitation and concern for entering the industry.

Our goal here is to help shed some light on how you can get in on this $12+ billion industry (estimated to shoot up to $66+ billion by 2025) legally – if you decide it’s the right move for your business. Given the nature of the industry, there will continue to be an increasing need for security, and some of these bids are worth some good money!

It should be noted, Silvertrac does not take a political or ethical stance on the cannabis industry or use. We are just here to provide facts and information relevant to the physical security industry, should you choose to go after cannabis bids.

Where is it Legal

As of January 2020, 33 states have legalized medical cannabis use and 11 states (along with Washington DC) have legalized both medical and recreational cannabis use. Most notable are California, Colorado, Oregon, and Washington, the first four states to legalize recreational use in the country.

To see a visual of cannabis legalization in the US, check out this map created by the National Cannabis Industry Association (NCIA).

In addition to the current legalized states, it is anticipated that another 6 states will likely vote to legalize recreational use in 2020.

Security Regulations

Because cannabis is regulated at the state level, it can be tricky to know exactly what regulations vendors have to abide by.

Silvertrac’s advice for anyone questioning what regulations apply to their business, regardless of what verticals they operate in, is to always assume the most strict regulations are the ones that you should follow.

In most instances, when dealing with security regulations, California’s laws and regulations are a great place to start. They are more often than not the leader in security standards. If you default to California, by the time your state comes around to upgrading their standards, you will likely already be compliant.

Here are a few resources on California standards to get you started:

- Medicinal and Adult-Use Cannabis Regulation and Safety Act (MAUCRSA)

- California Bureau of Cannabis Control (BCC)

- BCC Security Procedures Form – This is a great tool for planning out your cannabis security operations.

Video Surveillance Requirements

While there are a few different video surveillance requirements between states, the one standard requirement for all legalized states is that there must be 24/7 video surveillance for all entrances and exits at any dispensary.

Other common video surveillance requirements include:

- Minimum camera resolution

- Minimum frames per second

- Back-up systems & failure detection

- Areas surveilled

- Monitoring accessibility

- Video retention times (45/90/120 days)

For more information on these different areas of video surveillance requirements, these 3 articles are a great place to start:

- Requirements for AK, CO, OR, WA

- CA Requirements

- Additional Common Video Survelliance Requirements for Various Sates

For premises specific regulations, see section 500 of the BCC Text of Regulations.

Other things to keep in mind when researching video surveillance for cannabis security are:

Cannabis Security Trends & Best Practices

Any time you’re trying to break into a new vertical, it’s important to keep up on best practices and trends. We have compiled just a few for you here, but you can always check-out Silvertrac Extra for updated security best practices in a number of verticals, including cannabis security.

- 3 Security Must-Haves at Dispensaries

- 7 Security Tips for Cannabis Dispensaries

- What You Need in a Dispensary Security Plan

- 11 Key Elements in a Security Plan For a Cannabis Business Operation

- Cannabis Terminology Glossary

Now that you have a foundation for entering the cannabis industry, it begs the question, is your guard management software ready to take on the challenge? Silvertrac sure is! Request a demo today to see how you can simplify your security operation to take on new opportunities.

STAY CONNECTED WITH GUARD TOUR SOFTWARE

INCREASE THE VISIBILITY AND ACCOUNTABILITY OF YOUR SECURITY GUARDS WITH FLEXIBLE TECHNOLOGY OPTIONS

Team Software, CALSAGA Network Partner

Using guard tour software to keep track of your security guards is increasingly becoming standard practice, especially given the importance of accountability in the security industry. There are several ways to track your people and assets, and as technology continues to march forward, you have more options than ever before. Guard tour software typically uses one or more methods to track guard location, each bringing varied benefits, and each suited to different types of security contracts and requirements.

One example of a security company implementing guard tour software to achieve operational improvements is Trust Security Services, a privately-owned, licensed security agency servicing Maryland, Washington, D.C., and Virginia. Frustrated by expensive checkpoints, lackluster customer service and device limitations from a previous solution, Trust Security Services needed a better way to provide service to their customers.

Company leaders wanted a flexible tracking solution that would provide more visibility into their work and was backed by powerful reporting. So, they implemented Lighthouse, a workforce management platform from TEAM Software that provides complete visibility of workforces, mobile forms and workflows, and uses powerful reports to improve service delivery.

Trust Security Services’ goals when implementing Lighthouse included showing proof of work to minimize the risk of litigation, gaining a competitive advantage, providing real-time reports to improve the response time of dispatched teams, and accessing past patrol reports to check for accuracy.

To meet these goals, three key Lighthouse features work together to deliver complete visibility and accountability.

QR Code Network

A network of QR codes are located throughout the sites guards patrol. QR codes require a close proximity scan and require the user to open up an app or scanner to make that scan and are very inexpensive to implement. They can be produced automatically and sold for the price of a sticker. And, QR scanners are as ubiquitous as mobile devices.

Mobile App and Alerts

The dedicated Lighthouse security guard mobile app allows guards to scan QR codes at predefined checkpoints and passively monitors the location of guards in the background. The app is also used to record patrols, manage tasks, report issues, complete inspections and communicate with managers.

Location data is sent from the app to the Lighthouse platform in real time and allows managers to ensure both the safety of their guards and that they’re meeting their service requirements. A real-time activity feed creates faster response times and alerts for completed tasks and reported issues from the field.

Live Maps and Reports

Web-based reporting is used to monitor security services and improve performance over time. Live maps are used to quickly identify a guard’s location and assign tasks. Heat maps help ensure required patrols are being completed. Robust and centralized web-based reporting measures compliance with patrols and records tasks, issues and inspections.

By actively using Lighthouse across 12 locations, Trust Security Services was able to reach their intended goals, including winning a new contract based on visitor logs for access control built through the Tasks module in Lighthouse, saving money by switching to QR codes instead of using expensive checkpoints, and proving guards were where they were supposed to be after a theft at one of their sites prevented costly litigation.

As a security company, the solution you choose should be based on your specific applications and requirements. As guard touring technology evolves, it brings you new and innovative ways to leverage their capability to track people and assets across locations. The best guard tracking technology for you depends on the environment you’re working in and your goals. And, sometimes, it can even make sense to leverage multiple technologies across a single property.

WHAT’S THE DIFFERENCE BETWEEN AN ATS AND A JOB BOARD?

Jeff Davis, Kwantek, CALSAGA Network Partner

As we enter a new decade, it’s fun to reflect on how hiring has changed over the past 10 years.

As we enter a new decade, it’s fun to reflect on how hiring has changed over the past 10 years.

The job board landscape continues to ebb and flow. Dominant players from the early 2000’s, like Craigslist and Monster, have faded to the background, while new business models and social platforms continue to drive more applicants (is the term ‘freemium’ antiquated yet?).

Nothing has spurred change more than record low unemployment rates.

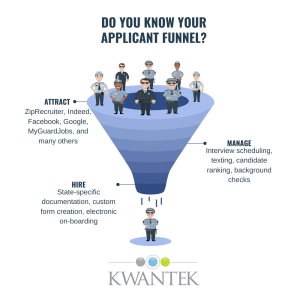

High-turnover industries have adopted digital marketing strategies to lure candidates and manage a pipeline. In these industries, the hiring process resembles a funnel. As competition for workers increases, high-turnover companies are rightly tempted to do everything they can to fill the top of that funnel with more applicants.

With dwindling margins and limited recruiting budgets, it’s tempting to look at spending all your budget on one job board simply for volume.

But the top of the funnel is only one stage to improve, and there are many ways to accomplish that goal. While job boards have added functionality over the past few years, they still don’t have the firepower needed for all recruiting organizations.

Before you make such a move, ask yourself these key questions:

Can the job board manage my hiring process? Job boards are designed to find applicants. Applicant Tracking Systems (ATS) are designed to move those applicants through your hiring process. A ‘one size fits all’ workflow may not be best for your organization if you have high hiring volume.

How will the applicant data flow into our other systems? Will the applicant information flow into your background check vendor and onboarding paperwork? What about your ERP or payroll?

Redundant data entry is frustrating and expensive, and let’s face it – no one wants to run afoul of state and federal requirements. EEO, I-9’s, the new W4, and constantly changing state requirements should all factor into your hiring workflow. If you’re only using a job board, be sure to have a separate system in place to gather critical employee paperwork to maintain compliance.

Am I getting all the information I need to make the right hire? The ‘easy apply’ trend has been fantastic for job seekers who can apply to multiple jobs in short order, but often employers need more info. Can the job board collect your entire application?

Will a single job board give me the quality applicants I need? Our data shows that different job boards attract different pools of candidates. Have you reviewed your hiring data to see which job board gives you the best quality candidates?

Like real estate markets, hiring is local and varies market to market.

We find that certain job boards work well in rural markets but fail in big cities. Some industries see fantastic results with ‘guerilla’ style recruiting tactics like fliers.

There is no perfect job board for all industries and markets, just like there is no singular hiring process for all organizations. Make sure you’re partnering with solution providers who diversify your applicant pool while helping you create efficiencies for your organization.

If you’d like to learn more about how to improve your hiring process, we’d love to talk! Click here to talk to us about your situation and see how Kwantek can help, or click here for additional helpful resources.

NEW YEAR, NEW DECADE, NEW LAWS!

2020 EMPLOYMENT LAW UPDATE FOR CALIFORNIA EMPLOYERS

Jaimee K. Wellerstein, Esq. & Annette M. Barber, Esq., Bradley & Gmelich LLP

As we ring in a new year and a new decade, California employers are faced with a number of important new laws. Following are some key employment laws taking effect this year:

- Sexual Harassment Training (SB 530): Last year, California employers were faced with SB 1343 which requires employers with at least 5 employees to provide at least one (1) hour of sexual harassment prevention training to all non-supervisory employees and two (2) hours for supervisory employees in California by January 1, 2020. SB 530 extends the deadline for mandatory sexual harassment training to January 1, 2021, and requires new supervisors to be provided trained within six (6) months of the assumption of a supervisory position.

Note that temporary services employers (including private patrol operators) must train all newly hired employees as of January 1, 2020, within 30 days of hire or 100 hours worked, whichever is earlier. Temporary services employers have until January 1, 2021 to train all current employees.

- Prohibition of Mandatory Arbitration Agreements (AB 51): Intending to ban mandatory arbitration agreements, AB 51 was scheduled to go into effect on January 1, 2020. However, on December 30, 2019, a federal court issued a last minute temporary restraining order blocking AB 51 from going into effect and scheduled a hearing.

If it goes into effect, AB 51 would prohibit employers from being able to require applicants and employees to enter into arbitration agreements as a condition of employment. For now, the temporary restraining order remains intact and the matter has been taken under submission. Supplemental briefing is to be filed by the parties on January 24, 2020.

- Sanctions for Failure of Employer to Timely Pay Arbitration Costs (SB 707): Employers must pay all arbitration fees and costs on time. If not paid within thirty (30) days, the employer is in material breach and waives its right to compel arbitration. Employer could then be subject to attorney’s fees and costs, and possibly evidentiary and terminating sanctions.

- Expansion of Lactation Accommodation Requirements (SB 142): Lactation space must now include running water, refrigeration to store milk, and electricity or charging stations for electric or battery operated breast pumps. The bill also provides for additional break time to express milk, policy requirements and penalties under the Labor Code for violations.

- Settlement Agreements (AB 749): AB 749 voids “no rehire” provisions in settlement agreements entered into on or after January 1, 2020. The law does include some significant exceptions, including where the employer made a good faith determination that the individual engaged in sexual harassment or assault. Further, the law does not require an employer to rehire an individual “if there is a legitimate non-discriminatory or non-retaliatory reason for terminating the employment relationship or refusing to rehire the person.”

- Independent Contractors (AB 5): AB 5 codifies the Dynamex Operations West, Inc. ruling, which changed the test used to determine whether California workers are deemed independent contractors. AB 5 codifies the “ABC” test, established in Dynamex, which presumes that all workers are employees, and places the burden on the hiring business to establish all of the following to classify a worker as a contractor: (A) the worker is free from the control and direction of the hirer in connection with the performance of the work; (B) the worker performs work that is outside the usual course of the hiring entity’s business; and (C) the worker is customarily engaged in an independently established trade, occupation or business of the same nature as the work performed for the hiring entity. If the company fails to establish any factor, the worker will be classified as an employee. Extreme care and caution should be used with regard to classification of all independent contractors.

- Prohibited Discrimination Based on Race Based Hairstyles (SB 188): Known as the Creating a Respectful and Open Workplace for Natural Hair (CROWN) Act, this law expands the definition of “race” under the California Fair Employment and Housing Act (FEHA) to include traits historically associated with race, such as hair texture and protective hairstyles. “Protective hairstyles” include, but are not limited to, “braids, locks, and twists.” The CROWN Act acknowledges the disparate impact workplace dress code and grooming policies potentially could have on black individuals. Policies that prohibit natural hair, including afros, braids, twists, and locks, are more likely to deter black applicants and burden or punish black employees than any other group. Employers should review their dress codes, grooming policies, and general hiring and employment practices to ensure compliance.

- Statute of Limitations for FEHA Claims Extended to Three Years (AB 9): Under existing law, the California Fair Employment and Housing Act (FEHA) requires that an employee alleging discrimination, harassment, or retaliation must first file a verified complaint with the Department of Fair Employment and Housing (DFEH) before filing a civil action in court. Currently, the employee has a one (1) year statute of limitations to file their DFEH complaint. AB 9, known as the Stop Harassment and Reporting Extension (SHARE) Act, extends the deadline to file a claim with the DFEH to three (3) years. Employers should note that AB 9 does not revive claims that have already lapsed under the current one-year statute of limitations rule.

- Amendment to California Consumer Privacy Act (“CCPA”) (AB 25): AB 25 clarifies that “consumers” under the CCPA includes employers, but exempts employers if they are collecting employee data for purposes solely relating to employment. However, this exemption will expire on January 1, 2021. For now, businesses must: 1) implement physical and electronic security measures to safeguard personnel information of employees and job applicants; and 2) provide a disclosure notice to employees and job applicants listing the categories of “personal information” collected about them and the purposes for which the information will be used. The disclosure may be provided to current employees through a handbook or memo, and to applicants at the time of

- Recovery of Civil Penalties for Unpaid Wages (AB 673): Employees now have the right to recover civil penalties for unpaid wages. These civil penalties were previously enforceable only through an action by the Labor Commissioner. Now, employees can recover $100 for each initial violation, and for a “subsequent violation, or any willful or intentional violation” of $200 for each failure to pay. AB 673 limits employee recovery to statutory penalties or civil penalties under the Private Attorney’s General Act (“PAGA”), but not both, for the same violation.

- Unpaid Wages (SB 688): Amending Labor Code section 1197.1, which currently permits the Labor Commissioner to cite employers for failing to pay at least the minimum wage, SB 688 expands the power to issue citations for violations of unpaid wages that were less than the wage set by contract in excess of minimum wage.

Jaimee K. Wellerstein is a Partner at Bradley & Gmelich LLP, and the Head of the firm’s Employment Department. Jaimee concentrates her practice in representing employers in all aspects of employment law, including defense of wage and hour class actions, PAGA claims, discrimination, retaliation, harassment, wrongful discharge, misclassification, and other employment related lawsuits. She also provides employment counseling and training in all of these areas.

Jaimee K. Wellerstein is a Partner at Bradley & Gmelich LLP, and the Head of the firm’s Employment Department. Jaimee concentrates her practice in representing employers in all aspects of employment law, including defense of wage and hour class actions, PAGA claims, discrimination, retaliation, harassment, wrongful discharge, misclassification, and other employment related lawsuits. She also provides employment counseling and training in all of these areas.

Jaimee routinely represents employers in federal and state courts and in arbitration proceedings throughout the state, as well as at administrative proceedings before the Equal Employment Opportunity Commission, the California Department of Labor Standards Enforcement, the United States Department of Labor, and other federal and state agencies. Jaimee assists as a Legal Advisor to CALSAGA, and is a member of ASIS International. She is rated AV-Preeminent by Martindale Hubbell, the highest peer rating available. jwellerstein@bglawyers.com / 818-243-5200.

Annette M. Barber is Special Counsel on Bradley & Gmelich LLP’s Employment Team. She represents clients providing employment advice and counsel in all aspects of hiring, performance management, training, compensation, and termination. Annette spent the past 17 years working with a global security company of 100,000 U.S. employees as an employment law attorney and then as Corporate Vice President directing HR Compliance nationwide for all 50 states, Puerto Rico and Guam.

Annette M. Barber is Special Counsel on Bradley & Gmelich LLP’s Employment Team. She represents clients providing employment advice and counsel in all aspects of hiring, performance management, training, compensation, and termination. Annette spent the past 17 years working with a global security company of 100,000 U.S. employees as an employment law attorney and then as Corporate Vice President directing HR Compliance nationwide for all 50 states, Puerto Rico and Guam.

Annette drafts and revises policies, handbooks, and extensive training materials for the firm’s clients. She provides workplace trainings, as well as workplace investigations. She is a member of the Association of Workplace Investigators, numerous bar associations and employment law sections. abarber@bglawyers.com / 818-243-5200.

IMPROVING RISK MANAGEMENT NEEDED AS INSURANCE COSTS RISE

Tory Brownyard, Brownyard Group

Over the last decade the security industry has enjoyed what we in the insurance business call a “soft market.” That means underwriting guidelines loosen, making it easy to obtain coverage, and premiums decrease for many accounts. In fact, some security firms have been seeing lower insurance rates today than they had 15 years ago.

However, a rash of large legal settlements is resulting in the hardening of the security insurance market. That is, insurers are losing their appetite for some risk. This means they are instituting stricter underwriting guidelines for security firms, increasing rates and (perhaps) limiting coverage offered, especially to those with a history of severe or frequent claims. Firms with a troubled risk profile are likely to see substantial rate increases.

Large Settlements

Among the large legal settlements involving security professionals in the last 10 years are several in California. In a case dating from 2006 involving a teenager who was disabled following a shooting in a Fontana public housing complex, the security firm patrolling the area was held partially liable for a $55 million settlement. The settlement was made in 2013 — meaning the case was in costly litigation for years.

In 2010, an immigrant house painter was brutally beaten by a security guard in a Los Angeles bar and left with brain damage. Three years later, the security firm was held directly liable for negligent hiring and training of an untrained, unlicensed guard, and a jury awarded the victim $58 million for pain, suffering and medical expenses.

While these cases are infrequent and do not follow a distinct pattern in terms of setting or victims, they are having wide-ranging consequences for the security industry and the role of security officers, as well as for the security insurance market. Security firms are being implicated more often in very costly suits. While frequency of claims for security firms is generally not an issue, the increase in the severity of the claims being brought against firms is a cause of concern for insurers. Plus, the increased severity that we’ve witnessed over the last decade not only affects the security firms involved in claims, but the industry as a whole.

The increase in frequency of active shooter incidents is also having an impact on the risk profile of security firms. Since 1982, California has had the highest number of active shooter incidents of any state, including the most in 2018. Security officers, which are often the first line of defense in these incidents, can be the target of claims that allege they failed to prevent the tragedy.

Improving Risk Profiles

While individual security firms may have little control over these industry-wide trends, they can improve their own risk profile and limit their liability in the event of an incident, thus helping them minimize rate increases and preventing denial of coverage by a trusted insurance partner.

As I discussed in an article in The Californian last year, there are specific steps security firms can take to reduce their exposure:

- Limit liability with carefully worded contracts. Some security services contracts may transfer a great deal of liability to a security firm, and that can be a problem when there is a claim. Instead, look for language that will limit liability to the security firm’s own negligence and not assume liability for a client’s negligence.

- Make sure contracts clearly state the duties and responsibilities of the security officers. This can help limit liability when sorting out the details after an incident.

- Make hiring and training a priority. Ensure security officers have an appropriate background for their posts. For example, insurers want officers with law enforcement experience at armed posts. In addition, make sure officers are trained for the specific settings in which they work. Underwriters like to see this type of situational training.

- Consider the different risks of different industries. When evaluating potential risk, underwriters look carefully at whether the industry is high-risk. These are posts that have a great deal of exposure to the public, large crowds or criminal activity, as well as active shooter risk.

These are just some of the issues to consider when discussing your insurance policy with your insurance broker. With changes in today’s insurance market, security firms will be well served by proactive risk management and loss control — efforts that may help secure insurance and limit premium increases.

Tory Brownyard, CPCU, is president of Brownyard Group (www.brownyard.com), an insurance program administrator with specialty programs for select industry groups. In addition to his responsibilities as President, he currently spearheads the Brownguard security guard insurance program. Tory is a highly-regarded subject matter expert in the field of Security insurance and has contributed to industry publications such as Security Magazine and has been featured regularly in leading insurance publications. He can be contacted at TBrownyard@brownyard.com.

Tory Brownyard, CPCU, is president of Brownyard Group (www.brownyard.com), an insurance program administrator with specialty programs for select industry groups. In addition to his responsibilities as President, he currently spearheads the Brownguard security guard insurance program. Tory is a highly-regarded subject matter expert in the field of Security insurance and has contributed to industry publications such as Security Magazine and has been featured regularly in leading insurance publications. He can be contacted at TBrownyard@brownyard.com.

DO YOUR FINANCIALS PROVE YOUR COMPANY’S WORTH IN A SALE TRANSACTION?

Robert Perry, Robert H. Perry & Associates, Incorporated

There have been several very large manned guarding companies sold to Private Equity Groups (PEG’s) over the past few years at multiples between 9 – 12 times the seller’s earnings before interest, taxes, depreciation and amortization (EBITDA), with nominal adjustments.

But the smaller companies, making up the majority of the roughly 8,000 companies in the US manned guarding market are not valued on the seller’s EBITDA when being sold to one of the seller’s larger competitors – usually the most generous of the buyers in the marketplace.

The acquisition of these smaller companies are a good source of growth for the larger PEG owned companies; in fact, the investors are demanding a series of acquisitions as a way to add shareholder value. Collectively, the very few PEG’s that have invested in the contract security industry over the past 10 years have bought over 200 privately held companies; providing the sellers the opportunity to retire and receive a well-earned reward for their many years of hard work. When these large PEG’s grow through acquisitions of smaller companies, they pay a multiple of their (the buyer’s) pro forma profit; which is usually much higher than what the seller was making before the acquisition since the buyer, in building the pro forma acquisition model, will consider the elimination of redundant costs of the combined companies after the sale.

The problem for many of these “would-be” sellers is that their companies do not have the financial systems in place to help the buyer in preparing a credible pro forma profit computation and the expenses that can be eliminated through combining the companies. These owners view the financial system only as a mechanism to file the year end taxes and not as an operating tool and especially not from the viewpoint of proving the real worth of the company when the time comes to sell.

We’re not necessarily talking about the owner needing audited year-end statements – although an audit certainly adds to the credibility of the financials. We’re talking about the owners having a series of ancillary reports and financials that correctly present the financial position of the company, which requires the proper recording of revenue and expenses. These financials will go much further than just reporting the net profits of the company; they will prove the real worth of the company by showing the specific elements of revenue and cost; important to the buyer in evaluating the merits of the acquisition. Sellers not being properly represented in the process, or trying to sell the company without any representation, usually don’t know how to present the financials; thus will sell the company for much less than it’s really worth. The company may have a very attractive gross profit, but it’s up to the seller to prove it; and proving it involves a lot more than just handing the buyer billing invoices and payroll registers for a couple of periods. The proof lies in the underlying financials that will confirm that the profit will remain at a certain sustainable level over time.

This is where we come in ….. our many years of managing transactions for seller/clients have enabled us to know exactly what the buyers are looking for and how to best present the financial information in order for our clients to receive top dollar in a sale transaction. This is how many of our seller/clients have received very attractive prices for companies that, based on historical financials, have been losing money or have been only marginally profitable.

We’ll guide the seller in presenting a meaningful gross profit line – a very important aspect of proving the worth of the company.

Although the operating expenses of the acquisition targets are scrutinized closely by the buyers, it’s the gross profit line that primarily drives the valuation. The buyer can improve on the general operating expenses through eliminating redundant costs after the acquisition, but there’s not much the buyer can do to improve on the profit at the customer site level. It can’t raise billing rates, and it can’t reduce the security officer pay and benefits without jeopardizing the relationship with the customers.

Sellers, in presenting the gross profit, should make sure all direct cost ( and only the direct cost ) relating to providing service to the customer is included in the gross profit section of the income statement, which will include: gross billing, all compensation to the site security officers (billable and non-billable), and other relates costs such as – payroll taxes, general and workers compensation insurance, uniforms, equipment furnished at the site, union dues, site supplies, hiring and employee processing expenses. If there are a lot of “cold start” accounts, the cost for some or all of the roving non-billable supervisors should also be included in the computation of gross profit.

We’ll advise on other financial statement adjustments and reports that are summarized and used to prove the worth of the company and become a part of the presentation to the buyer prospect:

- Customer Profit Report – This report will show every customer, by site, with the hours worked, gross billing, gross payroll, and any special costs that apply to the customer; such as dedicated site vehicles, special insurance, etc. A more advanced report will further show the billable and non-billable hours (vacation, holidays, training, etc.) with the associated billing and pay, as well as the overtime premium for both payroll and billings. Very important note: this initial information is used to prepare summary “gross profit statistics” only, and is not shown in detail for the presentation to the buyer prospects.

- Year-end and Interim Statements – Prepared on the accrual basis. Year-end financials prepared by an outside independent accounting firm adds credibility to the information. It’s also good to have interim statements, although not as important that the interim statements be prepared by the outside accounting firm. In order to help the buyer understand the financial picture, the statements should follow these guidelines:

- Sources of revenue and related costs should be identified to help a buyer verify the profit at the sites level, the statements will also identify the revenue according to source (i.e.; permanent accounts separate from temporary accounts, regular straight-time billing separate from overtime premium billing, and patrol and any other non-guarding service would also be a separate line item). The labor and other costs for the various sources of revenue will also be separated so the buyer can readily determine the profit by category of service (i.e.; how much it’s making on the permanent work vs. the temporary work, and how much its making on the patrol service, etc.).

- Proper cut-off of billing and expenses: A common mistake many companies make is not having a proper cut-off of billing and expenses. This especially true where a company has several billing periods available for the clients (i.e.; some on weekly, others on semi-monthly or monthly, etc.) that do not match the payroll period. When this is the case, the company should have a procedure in place to book the revenue that has been performed, but not billed, in order to get the billing in the same period as the recording of the labor for the respective service.

- Another common mistake is not properly recording advanced billings. This is more common for patrol customers than for guard customers, but in either case, if the invoice has been prepared and entered in the financial system before the service is actually rendered, the billing should be booked as advanced billings then recognized when the service is actually performed.

- Expenses below the gross profit line should be detailed since the buyer will be scrutinizing these costs. The buyer is looking for possible other costs that may be important to running the site, but may have been left out of the site level profit computation.

-

-

- Insurance – insurance expense should be separated to show the amounts for workers compensation, general liability, employee hospitalization and health, etc.

- Class of Compensation – compensation should be separated to show the amounts for non-billable roving supervisors, executives, clerical personnel, dispatch personnel and any other class of labor. The more detail, the better it will help the buyer understand what it takes to run the business.

- Vehicle Cost – to the extent it can be easily identified, vehicle cost should be separated by roving supervisors and executives.

-

For over 25 years we have successfully completed over 250 sell-side engagements for security companies located in 8 countries and having revenues between $2M – $200M.

The information in this article does not render legal, accounting or tax advice. Neither Robert H. Perry & Associates, Incorporated nor its employee, offer such services, and accordingly assume no liability whatsoever in connection with the use of the information contained herein. If legal, accounting, or tax advice is required, the services of a competent professional should be obtained.

© All rights reserved. May not be reproduced without permission.

2020 MARKET FORECAST

Shaun Kelly, Tolman & Wiker, CALSAGA Preferred Broker

Now that we are in a new year, it is good to reflect on the past year and look at what to anticipate for the year(s) to come. Insurance rates and premiums are based on historical loss data, trends, economic conditions and many other factors. We are going to share some 2019 overall industry results, how they will affect 2020 and influence premiums and limit coverage. Then we will review the Security Industry, which is insured primarily through “Program Underwriters”. Many may be influenced by the overall industry results, but more often they beat to their own drum when it comes to premium and coverage changes based on their own experience.

2019 Industry Results

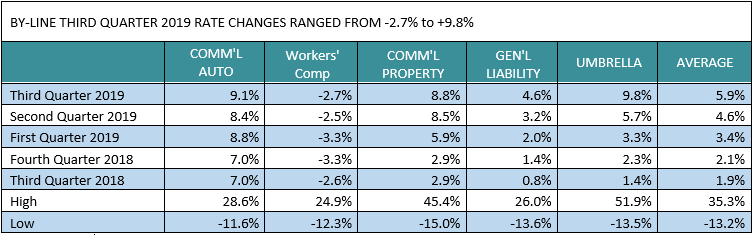

- Premium pricing across all-sized accounts increased moderately at 6.2% in Q3 2019, marking the eighth consecutive quarter of rate increases. Large accounts were impacted the most by the hardening market, recording an average premium increase of 7.6%, compared to 5.6% in Q2 2019.

- With the exception of Workers’ Compensation, signs of market hardening were seen across all commercial lines of business, which experienced slight-to-moderate pricing increases in Q3 2019. Umbrella and Commercial Auto were hit hardest in Q3, with average price increases of 9.8% and 9.1%, respectively. The average premium increase across all major lines was 5.9%, in comparison to 4.6% in Q2 2019 and 3.4% in Q1 2019.

Source: The Counsel of Insurance Agents and Brokers. Chart prepared by Barclays Research

Driving these rate increases have been losses in the property, auto and umbrella lines of business, coupled with low interest rates. Property losses, auto losses and low interest rates can be explained rather easily, however the claims that are piercing the umbrella coverage are becoming more frequent and much more costly than they have been in years prior. The introduction of “Nuclear verdict” and “Social inflation” have the industry concerned about the correct pricing that is required to cover future losses.

A “Nuclear verdict” can be defined as a settlement greater than would be expected based upon the facts of the claim and the nature of the injuries. Typically, settlements greater than $10 million.

“Social inflation” is more complicated and influences the nuclear verdict. Factors driving social inflation include litigation funding, the erosion of tort reform, negative public sentiment toward larger businesses and corporations, plaintiff friendly legal decisions and larger jury awards.

Media and plaintiff attorneys have done a good job of painting the picture of big bad corporations operating their business unethically, taking advantage of employees and reaping huge profits. Aggressive plaintiff attorneys are activating the emotional side of jurors and suggesting that corporations must be punished and pay for their wrong doing. Large nuclear verdicts are occurring more often and no end in sight.

Security Industry 2020 Forecast

The Security Industry (Program underwriters) does not always follow the information provided above, however there are similarities on certain lines of business. An advantage to having insurance in Industry Programs, based my 29 years of experience in the Security Industry, is that Programs respond slower to a hard market (Increase in pricing) and faster to enter a soft market (Decrease in pricing).

Except for Workers Compensation, premiums are firming up for the other lines of coverage for 2020. Lines of coverage that will be affected the most in 2020 will be Auto, General Liability, Employment Practices Liability and possibly Umbrella (If you have a large fleet of autos).

Auto insurance has been a loss leader for all Program Underwriters for many years and rates have been increasing each year. The only way Auto can be written, is when a complimentary line of insurance (General Liability or Workers Compensation) is written in addition to the Auto. Premiums for Auto written on a stand-alone basis are normally much higher. Expect premiums to increase significantly, or we may see insurance carriers discontinue writing Auto.

*Please note, if you have a large fleet of autos, you may experience increased Workers Compensation and Umbrella premium. With the frequency and severity of Auto losses, injuries to employees occur which result in Workers Compensation claims. Also, with more Autos, there is a higher probability of having a large Auto loss that could pierce the Umbrella coverage.

Rate variances on General Liability may be -5% to +5% in 2020, depending on your loss experience and operations. However, General Liability policies are changing and restricting coverage for certain types of operations. You need to review your policy to determine if you have any exclusions/limitations. For example:

- Low income housing

- Cannabis operations

- Liquor establishments

- Special events

- Schools

- Fast food restaurants

- Religious establishments

- Other

These exclusions/limitations are another way for an insurance carrier to reduce claim activity and not have to increase pricing. This way they can stay competitive, so please ask about coverage not just pricing.

Employment Practices Liability is a difficult conversation. If you have not had a PAGA or Wage & Hour claim you are lucky! And I would say, “If you have not had one yet”, watch out you probably will at some point in time. Premiums are increasing and expect increases each year going forward unless something changes dramatically. Premium increases vary based on coverage and deductibles/retentions and range from 5% to 15% with no claim activity.

Umbrella premiums will be affected by the Auto fleet and loss history. Limits up to $10 million are available at reasonable premiums, limits above $10 million may have coverage limitations and premiums vary.

In summary, except for Auto and Employment Practices Liability, expect minimal premium changes in 2020. Auto premiums are going to experience increases and they could influence premiums in other lines of coverage based on fleet size and loss history. I did not mention Property Insurance because this is not a significant line of coverage for the majority of our security clients. You may hear some horror stories regarding increases in Property Insurance premiums, the stories are true. Property premiums are skyrocketing for large property risks.

Thank you for your time.

Shaun Kelly joined Tolman & Wiker Insurance Services in 2005. He specializes in all lines of property and casualty insurance for industries including contract security firms, agriculture, construction, oil and gas. Shaun received a BS in Business Administration with a major in Finance from California State University in Fresno, California. He is an active member of several industry associations, including the Association CALSAGA, the Kern County Builders Exchange and the Independent Insurance Agents of Kern County. Shaun can be reached at 661-616-4700 or skelly@tolmanandwiker.com.

Shaun Kelly joined Tolman & Wiker Insurance Services in 2005. He specializes in all lines of property and casualty insurance for industries including contract security firms, agriculture, construction, oil and gas. Shaun received a BS in Business Administration with a major in Finance from California State University in Fresno, California. He is an active member of several industry associations, including the Association CALSAGA, the Kern County Builders Exchange and the Independent Insurance Agents of Kern County. Shaun can be reached at 661-616-4700 or skelly@tolmanandwiker.com.