2020 MARKET FORECAST

Shaun Kelly, Tolman & Wiker, CALSAGA Preferred Broker

Now that we are in a new year, it is good to reflect on the past year and look at what to anticipate for the year(s) to come. Insurance rates and premiums are based on historical loss data, trends, economic conditions and many other factors. We are going to share some 2019 overall industry results, how they will affect 2020 and influence premiums and limit coverage. Then we will review the Security Industry, which is insured primarily through “Program Underwriters”. Many may be influenced by the overall industry results, but more often they beat to their own drum when it comes to premium and coverage changes based on their own experience.

2019 Industry Results

- Premium pricing across all-sized accounts increased moderately at 6.2% in Q3 2019, marking the eighth consecutive quarter of rate increases. Large accounts were impacted the most by the hardening market, recording an average premium increase of 7.6%, compared to 5.6% in Q2 2019.

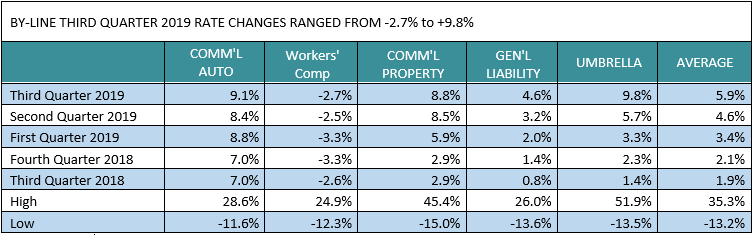

- With the exception of Workers’ Compensation, signs of market hardening were seen across all commercial lines of business, which experienced slight-to-moderate pricing increases in Q3 2019. Umbrella and Commercial Auto were hit hardest in Q3, with average price increases of 9.8% and 9.1%, respectively. The average premium increase across all major lines was 5.9%, in comparison to 4.6% in Q2 2019 and 3.4% in Q1 2019.

Source: The Counsel of Insurance Agents and Brokers. Chart prepared by Barclays Research

Driving these rate increases have been losses in the property, auto and umbrella lines of business, coupled with low interest rates. Property losses, auto losses and low interest rates can be explained rather easily, however the claims that are piercing the umbrella coverage are becoming more frequent and much more costly than they have been in years prior. The introduction of “Nuclear verdict” and “Social inflation” have the industry concerned about the correct pricing that is required to cover future losses.

A “Nuclear verdict” can be defined as a settlement greater than would be expected based upon the facts of the claim and the nature of the injuries. Typically, settlements greater than $10 million.

“Social inflation” is more complicated and influences the nuclear verdict. Factors driving social inflation include litigation funding, the erosion of tort reform, negative public sentiment toward larger businesses and corporations, plaintiff friendly legal decisions and larger jury awards.

Media and plaintiff attorneys have done a good job of painting the picture of big bad corporations operating their business unethically, taking advantage of employees and reaping huge profits. Aggressive plaintiff attorneys are activating the emotional side of jurors and suggesting that corporations must be punished and pay for their wrong doing. Large nuclear verdicts are occurring more often and no end in sight.

Security Industry 2020 Forecast

The Security Industry (Program underwriters) does not always follow the information provided above, however there are similarities on certain lines of business. An advantage to having insurance in Industry Programs, based my 29 years of experience in the Security Industry, is that Programs respond slower to a hard market (Increase in pricing) and faster to enter a soft market (Decrease in pricing).

Except for Workers Compensation, premiums are firming up for the other lines of coverage for 2020. Lines of coverage that will be affected the most in 2020 will be Auto, General Liability, Employment Practices Liability and possibly Umbrella (If you have a large fleet of autos).

Auto insurance has been a loss leader for all Program Underwriters for many years and rates have been increasing each year. The only way Auto can be written, is when a complimentary line of insurance (General Liability or Workers Compensation) is written in addition to the Auto. Premiums for Auto written on a stand-alone basis are normally much higher. Expect premiums to increase significantly, or we may see insurance carriers discontinue writing Auto.

*Please note, if you have a large fleet of autos, you may experience increased Workers Compensation and Umbrella premium. With the frequency and severity of Auto losses, injuries to employees occur which result in Workers Compensation claims. Also, with more Autos, there is a higher probability of having a large Auto loss that could pierce the Umbrella coverage.

Rate variances on General Liability may be -5% to +5% in 2020, depending on your loss experience and operations. However, General Liability policies are changing and restricting coverage for certain types of operations. You need to review your policy to determine if you have any exclusions/limitations. For example:

- Low income housing

- Cannabis operations

- Liquor establishments

- Special events

- Schools

- Fast food restaurants

- Religious establishments

- Other

These exclusions/limitations are another way for an insurance carrier to reduce claim activity and not have to increase pricing. This way they can stay competitive, so please ask about coverage not just pricing.

Employment Practices Liability is a difficult conversation. If you have not had a PAGA or Wage & Hour claim you are lucky! And I would say, “If you have not had one yet”, watch out you probably will at some point in time. Premiums are increasing and expect increases each year going forward unless something changes dramatically. Premium increases vary based on coverage and deductibles/retentions and range from 5% to 15% with no claim activity.

Umbrella premiums will be affected by the Auto fleet and loss history. Limits up to $10 million are available at reasonable premiums, limits above $10 million may have coverage limitations and premiums vary.

In summary, except for Auto and Employment Practices Liability, expect minimal premium changes in 2020. Auto premiums are going to experience increases and they could influence premiums in other lines of coverage based on fleet size and loss history. I did not mention Property Insurance because this is not a significant line of coverage for the majority of our security clients. You may hear some horror stories regarding increases in Property Insurance premiums, the stories are true. Property premiums are skyrocketing for large property risks.

Thank you for your time.

Shaun Kelly joined Tolman & Wiker Insurance Services in 2005. He specializes in all lines of property and casualty insurance for industries including contract security firms, agriculture, construction, oil and gas. Shaun received a BS in Business Administration with a major in Finance from California State University in Fresno, California. He is an active member of several industry associations, including the Association CALSAGA, the Kern County Builders Exchange and the Independent Insurance Agents of Kern County. Shaun can be reached at 661-616-4700 or skelly@tolmanandwiker.com.

Shaun Kelly joined Tolman & Wiker Insurance Services in 2005. He specializes in all lines of property and casualty insurance for industries including contract security firms, agriculture, construction, oil and gas. Shaun received a BS in Business Administration with a major in Finance from California State University in Fresno, California. He is an active member of several industry associations, including the Association CALSAGA, the Kern County Builders Exchange and the Independent Insurance Agents of Kern County. Shaun can be reached at 661-616-4700 or skelly@tolmanandwiker.com.