Beyond Theory: Analytics and AI Reshaping Security Operations

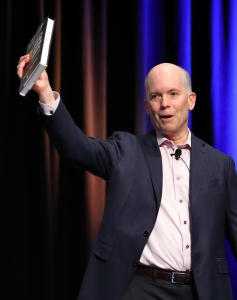

David Libesman, TEAM Software by WorkWave, CALSAGA Network Partner

The security industry has steadily adopted technology solutions over the years. While some manual processes still exist, many companies are now using ERP systems and mobile tools to manage their workforce and operations. Now, the industry is on the precipice of seeing a meaningful shift yet again.

Ever since AI chatbots and learned language models hit the mainstream market, there’s been buzz about how advanced analytics and artificial intelligence might one day transform security operations. What’s different now is that the buzz is being turned into action: security companies are able to see, with tangible deliverables in reach, what this disruption might actually mean for their business. In my role as SVP and GM of AI & Data Analytics at WorkWave, I’m fortunate enough to meet with security leaders in the TEAM Software network firsthand and really be able to talk through the practical applications and real results these changes will bring.

Disrupting the Security Industry

While many security companies use digital systems for their operations, these core platforms can lack the advanced analytics capabilities needed to fully optimize the workforce. Even with an ERP system in place, when data isn’t being fully leveraged for decision-making, the results are predictable: higher costs, lower efficiency and compromised service delivery on contracts.

Think about some of the most common problems you experience day-to-day:

- Labor shortages and high turnover make maintaining proper staffing difficult

- Scheduling inefficiencies and errors

- Limited access to real-time information leads to reactive management

- Difficulty proving compliance with SLAs, leading to client churn

These, among others, always boil up to the surface because they directly impact your bottom line. And, many of these issues can be helped by improving one thing: your data.

While AI is the buzzword of disruptors, a foundational element of AI’s success relies on the quality of data being taken into account. When AI is built using a powerful data warehouse as its keystone, then the possibilities become endless. Stakeholders in meetings are no longer forced to choose which system of record to believe in if the numbers don’t match up. Field supervisors can access information in near-real time, leading to agility in operations and same-shift decision-making. With data as the root of the reason behind AI, the possibilities become endless.

Layering Intelligence on Existing Systems

What’s important to understand about this technological disruption is that analytics and AI aren’t replacing your current ERP or workforce management system – they’re enhancing it. By adding these capabilities on top of your existing platforms, you’ll be able to unlock new potential from the data you already collect. For example, you’ll be able to use it to:

Optimize Security Scheduling: AI-powered tools analyze your historical timekeeping data to predict staffing needs based on threat levels, property occupancy and events. This reduces overtime costs while ensuring proper coverage, even accounting for travel time between sites and guard qualifications.

Track Performance in Real Time: Advanced dashboards showing guard productivity, attendance patterns and patrol completion give managers immediate visibility, letting them address issues before client security is compromised.

Forecast Labor Needs: Predictive analytics turn your historical data into staffing forecasts weeks or months ahead, giving time to recruit and train staff before shortages occur.

The Business Impact

What do these improvements mean for security operations? In bottom-line terms, it means:

Lower Labor Costs: By optimizing staffing levels and reducing unnecessary overtime, security companies may be able to see significant reductions in labor expenses. When you consider that labor represents a very high percentage of operational costs in security, even small improvements deliver substantial savings.

Better Client Satisfaction: Analytics ensure qualified guards with appropriate training are consistently at the right locations. This reliability strengthens client relationships and leads to more valuable contracts.

Improved Employee Retention: More predictable scheduling, fewer last-minute changes and better matching of skills to assignments improve guard satisfaction. In an industry with high turnover, even modest improvements in staff stability create substantial savings in hiring and training.

Greater Operational Control: With systems handling reporting, performance tracking and resource allocation, security managers can focus on strategic priorities like business growth and client relationships.

From Talk to Action

These changes are moving fast. There is no doubt that companies that add these analytical capabilities to their current platforms gain a competitive edge. You’ll manage workforce challenges more effectively, control labor costs more precisely, and position your business for health–even as the economy tightens. For security, the future is happening now – visit teamsoftware.com for more information.

David Libesman, SVP & GM, AI& Data Analytics Business Unit at WorkWave

David Libesman, SVP & GM, AI& Data Analytics Business Unit at WorkWave

David Libesman is a visionary SaaS executive with an entrepreneurial spirit and track record of developing, monetizing and growing data analytics & AI product strategy and business. David is well-versed in driving strong sales through enterprise channels, as well as building, developing and retaining high-performing teams. He aims to bring best of breed AI and analytic capabilities to boost growth and profits for TEAM Software customers through data-driven strategies.