Why Post Orders Matter More Than You Think

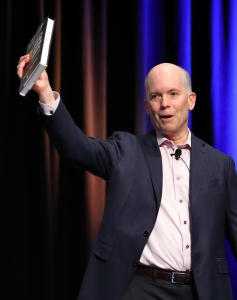

Courtney Sparkman, OfficerApps, CALSAGA Associate Member

Most security problems do not begin with bad intentions. They begin with unclear direction from managers and supervisors.

In the security industry, post orders are often treated as a formality. Something written once, handed to an officer, and rarely revisited unless something goes wrong. Yet, post orders quietly define how a security officer’s authority is exercised, how judgment is applied, and how a security company presents itself to the clients it is supposed to protect.

A story from hospital security shows exactly what happens when post orders exist without a process behind them.

When Following Post Orders Becomes the Problem

A security officer working armed security at a large hospital was assigned to the main entrance. This was a busy trauma center in a rou\gh part of town where real security issues were constant and ongoing. There were mental health patients fighting in the ER. Strange people wandering into restricted areas. Vulnerable patients getting lost. All situations that required a security officer with presence, discretion, and sound judgment.

Then a new instruction came down. The officer was told to post up at the main entrance to keep hospital staff out. Not because of a threat or an operational risk, but because someone in middle management decided employees should use a different door to keep the entrance clear for patients and guests.

Doctors, nurses, facilities staff, and janitorial teams were redirected. Anyone who refused would have their name recorded for reprimand. The instruction made little sense to the officer because it pulled attention away from real risks and replaced it with administrative enforcement that added no security value. But the post orders were clear enough. This was now his post.

When Post Orders Collide With Reality

One day, a man in a suit approached the entrance leading a group of well-dressed executives. All wore employee badges. The man at the front, from his stature, was clearly important.

Following his post orders, the officer stopped the group and redirected them to the West entrance. When the man insisted on using the main entrance, the officer calmly explained the policy and informed him that names would be taken and supervisors notified. So he did exactly that. Every name. Slowly. Carefully.

When the security supervisor reviewed the list, one name stood out immediately. It was the name of the Chief Executive Officer.

The well-dressed man that the security officer stopped was the CEO of the entire health system who was escorting potential investors around the hospital. The CEO had never been informed of the policy change.

As you can guess, the policy was quietly reversed, and staff were once again allowed to use the main entrance.

Common sense eventually won. But only after wasted time, unnecessary friction, and reputational risk.

What This Story Is Really About

This is not a story about a bad officer. He did exactly what he was told. It is not even a story about a bad policy; poor policies exist in every organization. What it is, is a story about post orders created without a process.

Post orders do more than tell officers what to do. They determine whether officers are empowered to apply judgment or forced to enforce instructions that were never tested against reality. When post orders are written without a full understanding of the environment, officers are left choosing between common sense and compliance.

In this case, compliance exposed the weakness in the system.

Why Post Orders Require Discipline, Not Just Documentation

Effective post orders do not begin with the purpose of accomplishing some goal.

Every instruction in the post order should tie back to a clear security or operational objective. If an order cannot be explained in terms of risk reduction, safety, or operational control, it does not belong in the post orders. Administrative convenience and internal politics should never be enforced by front line security…although it happens more than enough.

Post orders also require validation before deployment. Any instruction that affects access, movement, or behavior within a facility must be reviewed with the stakeholders that ultimately owns the space. In the hospital example, the CEO was unaware of a policy that directly affected how his organization operated. That gap alone guaranteed failure.

Officers must also be part of the process. Experienced officers know immediately when an instruction will create distraction, conflict, or confusion. When there is no mechanism for that feedback to move upward, flawed post orders survive longer than they should.

Finally, post orders must be treated as living documents. Even well-intentioned instructions can deteriorate over time. This usually happens when client expectations change, threat profiles evolve, or most commonly when leadership turns over. Rules that once made sense quietly become liabilities when not revisited.

By scheduling regular reviews of your post orders, security organizations can address any necessary questions before embarrassment or incidents happen. Without regular reviews officers may bend a rule to do their job when the rule is the problem.

The Real Value of Getting Post Orders Right

When a disciplined process exists, post orders support and officer’s judgment instead of replacing it. As a result officers are not forced into robotic enforcement which leads to supervisors spending less time managing fallout and ensuring client satisfaction.

Post orders are not just miscellaneous paperwork, they are operational intent made visible. When they are wrong, everyone feels it. Sometimes at the front door, in front of investors, with a CEO holding his badge in the air.

Either way, the lesson is the same, post orders matter.

Courtney W. Sparkman is the founder and CEO of OfficerApps, the umbrella technology platform behind OfficerReports, OfficerHR, and OfficerBilling, a suite of purpose built tools designed exclusively for security guard companies. With more than two decades of hands on experience in security operations, sales, and executive leadership, Courtney brings deep industry knowledge paired with a practical, operator first approach to technology and growth.

Courtney W. Sparkman is the founder and CEO of OfficerApps, the umbrella technology platform behind OfficerReports, OfficerHR, and OfficerBilling, a suite of purpose built tools designed exclusively for security guard companies. With more than two decades of hands on experience in security operations, sales, and executive leadership, Courtney brings deep industry knowledge paired with a practical, operator first approach to technology and growth.

Prior to founding OfficerApps, Courtney held senior leadership roles across the security industry. He had most recently served as Director of Business Development for Diamond Detective Services, where he led national growth initiatives, pursued public and private sector opportunities, and consistently won competitive bids through strategic prospecting, client presentations, and proposal driven sales.

Earlier in his career, Courtney served as Vice President of Operations and Sales at Cequr Security, a security guard company he co-founded with his father. During his seven-year tenure, he was directly responsible for client acquisition and retention, developing training standards, and implementing quality assurance initiatives. The operational challenges and lessons from that experience directly inspired the creation of the OfficerApps platform.

In addition to leading OfficerApps, Courtney is the publisher of Security Guard Services Magazine. The only magazine dedicated to the security guard services industry where he covers industry leadership, technology, and the future of manned guarding. He is also a speaker and author, frequently sharing insights on how security companies can modernize operations, scale profitably, and remain competitive in a rapidly evolving marketplace.

Courtney previously held a private security contractor license in the state of Illinois, earned through a rigorous background check and licensing examination. He holds a Bachelor of Science in Agricultural Economics from the University of Illinois at Urbana Champaign and is currently a candidate for a Master of Science in Emergency Management from the University of Chicago.