UPDATE 10/7/24

Per the California Department of Health Care Services, the increase shall go into effect on October 16, 2024.

UPDATE 6/22/24

The increase will be delayed until either October 2024 or January 2025 depending on the California state budget. More information will be provided as it is available.

UPDATE 5/21/24

The increase was scheduled to go into effect next week but could be delayed to July 1, 2024.

Sponsor of the original legislation, Senator Durazo submitted SB 828 which would allow for the delay. In a statement the senator stated:

SB 828 moves the start date of the health care minimum wage by one month to July 1, 2024. This aligns SB 525 with the budget year and allows the Legislature to continue discussions with the Administration and technical changes to ensure health care workers get their raises.

UPDATE 5/30/24

SB 828 has passed in the Senate and is on the way to the Governor’s office. He is expected to sign it soon.

Is Your Security Company Ready For The California Healthcare Workers Minimum Wage Increase?

By

Barry A. Bradley, Esq.

Jaimee K. Wellerstein, Esq.

Michael J. Bruskin, Esq.

For any security company providing officers at a healthcare facility, the minimum wage for those assigned officers increases on June 1, 2024. This is, as you may recall, the result of Governor Newsom’s signing of Senate Bill (SB) 525, now codified as California Labor Code sections 1182.14 and 1182.15. It is a state-wide minimum wage increase for healthcare workers about to be phased-in, and increases over time. This new law includes the employees of contractors and other vendors who perform work on-site at covered healthcare facilities, including Private Patrol Operators (“PPOs”). (For County-owned healthcare facilities, the increase is delayed until January 1, 2025.)

[CAVEAT: In light of the current budget deficit coupled with the fact this minimum wage increase will impact State employees, as well, Governor Newsom is considering a delay in the implementation, perhaps into next year. However, as of now, it is currently scheduled to go into effect June 1st.]

Background

Due to rising wages across all industries and the challenges faced by the healthcare industry presented by the COVID-19 pandemic and subsequent staffing shortages in medical facilities nationwide, the California legislature put forth an expansive bill to increase the minimum wage for healthcare workers. These changes apply substantially to all employees working at a “covered healthcare facility,” who are considered “covered healthcare employees” under the new law. This definition is expansive and includes almost everyone. Indeed, the statute explicitly includes “guards” within the definition of “covered healthcare employees.” It further includes all contractors (such as PPOs) and vendors who perform work on-site at such facilities.

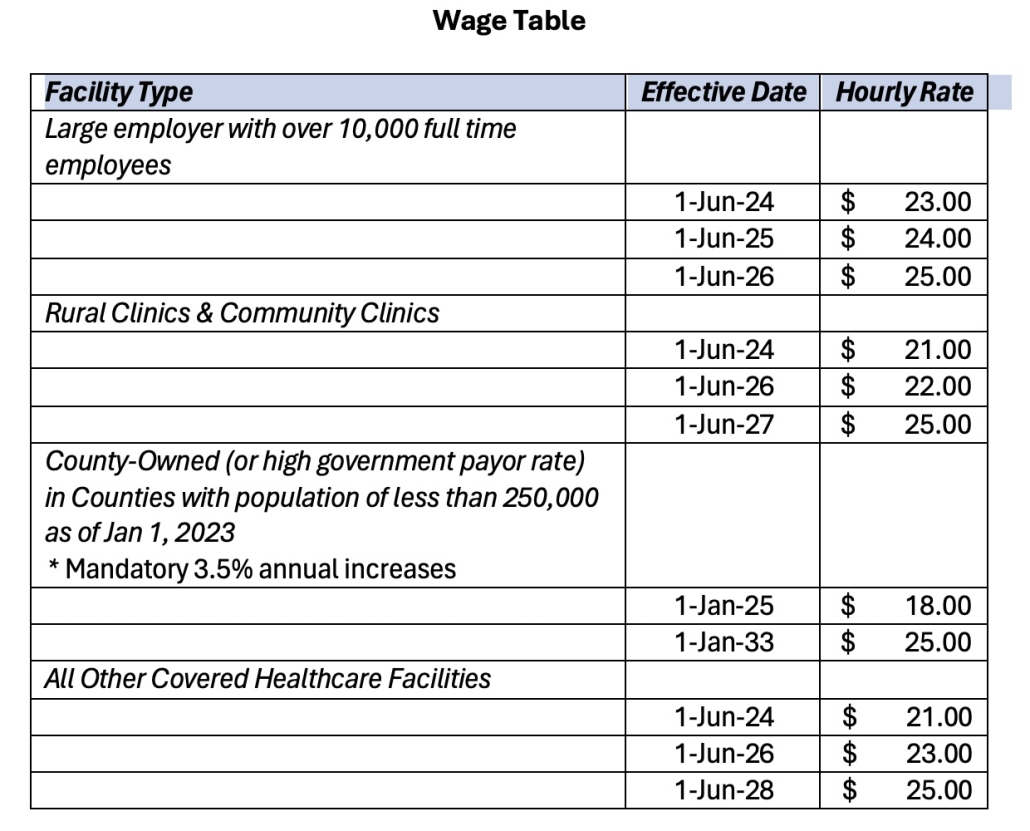

The new law includes a staged increase in minimum wage over the next several years, with different wage rates depending on the type of facility, its location, and number of total employees for the combined employer group. There are four different wage rate schedules:

- Health facility employers with 10,000 or more full-time equivalent employees;

- Rural clinics and community clinics;

- Hospitals with a “high governmental payor mix” (defined as 90% or more payors being Medicare or Medi-Cal) or county-owned hospitals in counties with a population less than 250,000 as of Jan 1, 2023; and

- All other covered healthcare facilities.

The following table represents the effective dates and the required minimum wage for each of these types of facilities.

[In addition to the scheduled increase in pay rates in the table, rates will increase each year on January 1st after the maximum scheduled rate takes effect in an amount equal to either 3.5%, or the percentage increase in the US Consumer Price Index for Urban Wage Earners & Clerical Workers, whichever is lesser.]

Overtime Calculations

This statute has implications in the calculation of overtime and the Regular Rate of Pay, as well. This is of particular note for employers who have employees who split time during a pay period between different locations or wage rates and who must calculate the Regular Rate of Pay as a blended rate before calculating overtime.

Under the FLSA, the regular rate of pay for any given shift can never be less than the applicable minimum wage for that shift. SB 525 is a minimum wage statute. All shifts worked under the applicable minimum wage here and which accrue overtime wages must be paid at no less than 1.5 times this wage, even if they would have a lower “regular rate” under ordinary rate blending calculations. In such cases, the regular rate for all other shifts must still be calculated using the standard regular rate methodology.

Security Company Takeaways

- Rate Increases: If you provide security to a healthcare facility, you must pay those officers the new minimum wage, if you are not already. If any of your clients are covered healthcare facilities , you should reach out to them to determine which category they fall into to determine the new minimum wage rate applicable to both the client and your officers. Determine whether or not they are County-owned and subject to the January 1, 2025 implementation. Otherwise, they are subject to the June 1, 2024 deadline. PPOs must consider updating and increasing your hourly billing rates to account for these government-mandated increases to compensation for your employees.

- Regular Rate of Pay” Calculations: Employers should review their payroll practices to ensure they are calculating the regular rate and overtime appropriately for all shifts, particularly in cases where employees operate under multiple pay rates during a single pay period.

- Exempt Employees – Paying the Minimum Threshold Increases: If you have any exempt employees working on-site at any of these covered healthcare facilities, ensure their salary remains at least twice the new applicable minimum wage as the wage rates increase in order to maintain their exempt status. Remember to keep this updated as the tiered increases progress.

If you have any questions about how this new law may affect your business or need assistance in determing the appropriate pay rate and timing, please contact your attorneys at Bradley, Gmelich & Wellerstein LLP. We are here to help.

Barry A. Bradley is the managing partner of Bradley, Gmelich & Wellerstein LLP where he oversees the firm’s Business and Employment Department and heads up the firm’s Private Security Team. A former Deputy District Attorney, Barry’s practice concentrates on BSIS licensing, employment and business-related issues, defending cases involving negligent security, as well as assisting clients in avoiding liability through proactive, preventative measures.

Barry A. Bradley is the managing partner of Bradley, Gmelich & Wellerstein LLP where he oversees the firm’s Business and Employment Department and heads up the firm’s Private Security Team. A former Deputy District Attorney, Barry’s practice concentrates on BSIS licensing, employment and business-related issues, defending cases involving negligent security, as well as assisting clients in avoiding liability through proactive, preventative measures.

The firm acts as general counsel for many security companies in California. Barry is a Legal Advisor to The California Association of Licensed Security Agencies, Guards & Associates (CALSAGA) and other non-profits.

He has been conferred an AV-Preeminent Peer Rating by Martindale Hubbell, the highest rating attainable, and has been named a Southern California Super Lawyer for the past 16 consecutive years in the area of Business Litigation. Barry is also the recipient of CALSAGA’s Security Professional Lifetime Achievement Award. bbradley@bgwlawyers.com 818-243-5200.

Jaimee K. Wellerstein, Esq. is a Partner and the firm’s Employment Team Head. Representing employers in all aspects of employment law, Ms. Wellerstein collaborates with her clients to develop proactive business and legal strategies to try to avoid workplace conflict and employment disputes. She provides legal advice and counsel to numerous businesses, including conducting individualized training programs for both management and employees.

Jaimee K. Wellerstein, Esq. is a Partner and the firm’s Employment Team Head. Representing employers in all aspects of employment law, Ms. Wellerstein collaborates with her clients to develop proactive business and legal strategies to try to avoid workplace conflict and employment disputes. She provides legal advice and counsel to numerous businesses, including conducting individualized training programs for both management and employees.

Ms. Wellerstein performs internal audits of her clients’ employment practices to ensure compliance with the rapidly changing world of employment laws, and guides investigations of employee allegations regarding harassment, discrimination, and employee misconduct. When litigation cannot be avoided, Jaimee K. Wellerstein aggressively defends her clients against employment law claims in the state and federal courts, as well as at administrative hearings, arbitrations, and mediations. Having defended numerous representative and individual lawsuits on behalf of her clients, Ms. Wellerstein is a skilled litigator and negotiator with a broad spectrum of experience upon which to draw.

A frequent speaker on numerous topics, including employment law and contract law, Ms. Wellerstein regularly conducts training seminars and programs for managers and employees in all areas of employment practices and policies. Jaimee is a Legal Advisor to The California Association of Licensed Security Agencies, Guards & Associates (CALSAGA).

Michael J. Bruskin, Esq. is Special Counsel on the firm’s Employment Team Advice & Counsel Practice Group. Advising employers in all aspects of employment law, Mr. Bruskin develops deep relationships and working knowledge of his clients’ operational preferences and devises forward-thinking strategies to align business needs with risk mitigation and legal compliance. Mr. Bruskin performs internal audits of his clients’ employment practices to ensure compliance with the rapidly changing world of employment laws and guides their employment and business strategies to create successful and lasting relationships with their employees.

About Bradley, Gmelich & Wellerstein LLP

Founded in 2000, Bradley, Gmelich & Wellerstein, LLP is dedicated to providing sound advice and exceptional results for our clients. Our twenty-five plus skilled, dedicated and diverse attorneys represent individuals and businesses of all sizes, with a special emphasis on security companies, in a wide variety of business, employment law and litigation matters. www.bgwlawyers.com.